Twisto is delivering a simple and fair daily financing solution to retail customers in the CEE region. The application allows one-click online purchases with the option to postpone the settlement. The application is not connected to any bank account, which makes the process more secure. Its cutting-edge risk engine Nikita is leveraging non-traditional data sources and machine learning for credit assessment, analyzing over 400 data points per transaction in milliseconds. Twisto is currently active in the Czech Republic and Poland. As of 2022, they have 1.6 million users and have partnered with over 4000 e-shops in the Czech Republic and Poland.

30+ devs

involved in the project

2 countries

Czechia and Poland

2 months

To launch a major new feature

Python

Codebase and Django stack

The Twisto app has been a leading element of the Czech fintech startup scene since 2013. To maintain its leadership as a payments innovator, Twisto engaged Vacuumlabs to support the development of essential customer experiences:

People at Vacuumlabs are incredibly smart, intelligent, and also have very senior experience. They know what they’re doing and can add value within a couple of days or weeks. For us, they are a guarantee of quality and an immediate boost to our development capacity.

CEO of Twisto

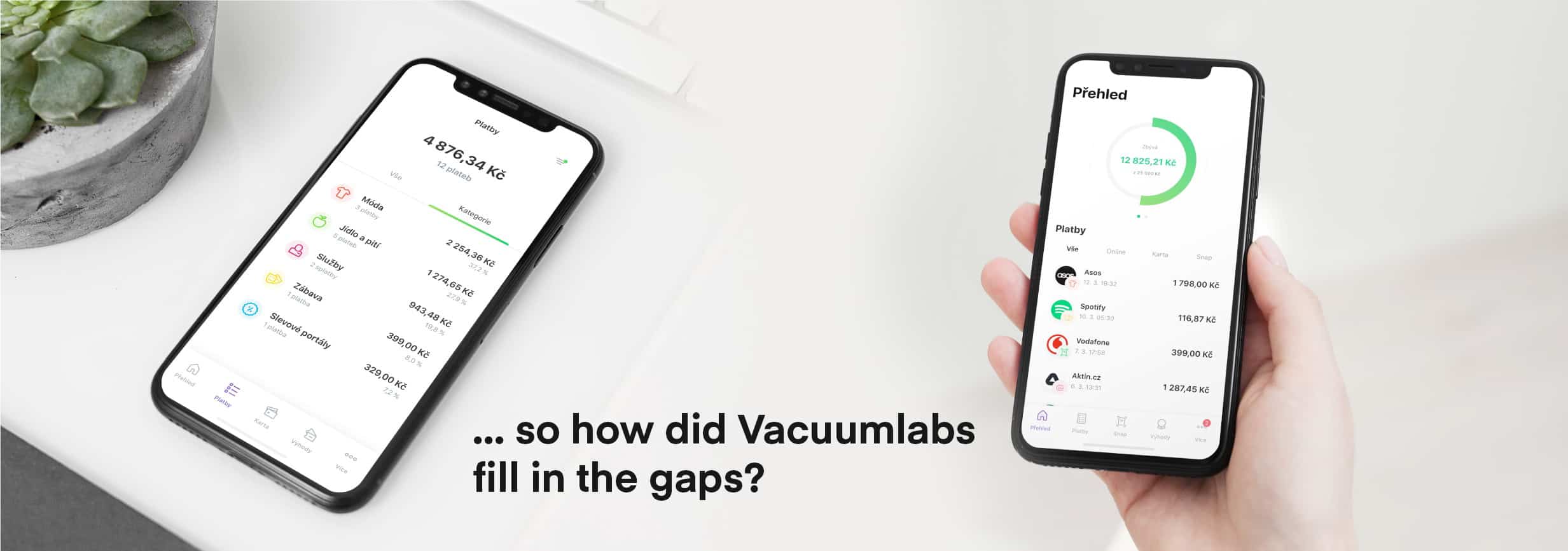

Our partnership with Twisto began with two Vacuumlabs engineers working on a shortlist of features. Over time, we increased the scope of our support, ultimately growing to a team of 30 engineers working seamlessly with Twisto’s teams. Our support resulted in a rapid growth in customer registration efficiency. Throughout our partnership, we have helped Twisto automate essential journeys and integrate a range of tools and payment options. These include:

Automated the processing of client data to improve registration speed for customers and make life easier for back office staff.

Installment plans provide more flexibility by allowing customers to spread payment between 3 to 12 months.

Only two months to launch installments which was a record time to launch a new feature

Hyper-targeted promotions to drive customer loyalty by messaging the right customers with the right message at the perfect time with Exponea

Streamlined payment collection for back office by integrating new CRM to track and chase customers who have missed payment.

Integrated Apple Pay functionality, giving customers a more choice in how they pay.

We continue to partner with Twisto, supporting them with additional integrations of third-parties systems and helping to enhance the functionality of the returns process. Our journey with Twisto has demonstrated our ability to work quickly and efficiently and navigate Twisto through the exciting world of next-generation payments.

In 2021, Twisto was acquired by the Australian based online payments platform Zip. Throughout this growth, Twisto continues to choose Vacuumlabs teams as their engineering partner to implement new features and expand to new markets.

Twisto is a business with the potential for exponential growth. Their own development team extends so it’s extraordinary they kept us as a third party vendor. We have formed the team responsible for the profitable features of the Twisto and have gained the trust for development and deployment without additional review. I appreciate the open communication and reception of any kind of feedback, thanks to which we were able to participate in the product and the creation process of Twisto.

Our team of experts will work closely with you to understand your goals and deliver a truly customized solution that meets your unique needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

Thank you for contacting us! One of our experts will get in touch with you to learn about your business needs.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You can also "Reject All".

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |